If you want to listen to the article press the button below.

What is blockchain technology?

A blockchain is a digital ledger of all cryptocurrency transactions. It is constantly growing as “completed” blocks are added to it with a new set of recordings. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data.

Bitcoin nodes use the block chain to differentiate legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.

The blockchain is an essential part of the cryptocurrency ecosystem and is considered by many to be the most important innovation in the space since the invention of Bitcoin. While the Bitcoin block chain is by far the most well-known, there are other blockchains with different characteristics and purposes. Ethereum, for example, focuses on running the programming code of decentralized applications.

Blockchain is essentially a digital ledger of all cryptocurrency transactions.

The key difference between a blockchain and a traditional ledger is that a blockchain is decentralized, meaning it is not centrally managed by a single authority.

A blockchain is a distributed database or ledger that is shared among the nodes of a computer network. As a database, a blockchain stores information electronically in digital format. Blockchains are best known for their crucial role in cryptocurrency systems, such as Bitcoin, for maintaining a secure and decentralized record of transactions.

The innovation with a blockchain is that it guarantees the fidelity and security of a record of data and generates trust without the need for a trusted third party.

One key difference between a typical database and a blockchain is how the data is structured. A blockchain collects information together in groups, known as blocks, that hold sets of information. Blocks have certain storage capacities and, when filled, are closed and linked to the previously filled block, forming a chain of data known as the blockchain. All new information that follows that freshly added block is compiled into a newly formed block that will then also be added to the chain once filled.

A database usually structures its data into tables, whereas a blockchain, as its name implies, structures its data into chunks (blocks) that are strung together. This data structure inherently makes an irreversible timeline of data when implemented in a decentralized nature. When a block is filled, it is set in stone and becomes a part of this timeline. Each block in the chain is given an exact timestamp when it is added to the chain.

How does blockchain technology work?

Blockchain technology is unique in that it allows two parties to conduct a transaction without the need for a third party like a bank. The transactions are recorded in a chronological order on a public network and are verified by network nodes. These nodes can be thought of as the “middlemen” between buyers and sellers. They ensure that the transactions are valid and that the blockchain remains tamper-proof.

The goal of blockchain is to allow digital information to be recorded and distributed, but not edited. In this way, a blockchain is the foundation for immutable ledgers, or records of transactions that cannot be altered, deleted, or destroyed. This is why blockchains are also known as a distributed ledger technology (DLT).

Blockchain Decentralization

Imagine that a company owns a server farm with 10,000 computers used to maintain a database holding all of its client’s account information. This company owns a warehouse building that contains all of these computers under one roof and has full control of each of these computers and all of the information contained within them. This, however, provides a single point of failure. What happens if the electricity at that location goes out? What if its Internet connection is severed? What if it burns to the ground? What if a bad actor erases everything with a single keystroke? In any case, the data is lost or corrupted.

What a blockchain does is to allow the data held in that database to be spread out among several network nodes at various locations. This not only creates redundancy but also maintains the fidelity of the data stored therein—if somebody tries to alter a record at one instance of the database, the other nodes would not be altered and thus would prevent a bad actor from doing so. If one user tampers with Bitcoin’s record of transactions, all other nodes would cross-reference each other and easily pinpoint the node with the incorrect information. This system helps to establish an exact and transparent order of events. This way, no single node within the network can alter information held within it.

Because of this, the information and history (such as of transactions of a cryptocurrency) are irreversible. Such a record could be a list of transactions (such as with a cryptocurrency), but it also is possible for a blockchain to hold a variety of other information like legal contracts, state identifications, or a company’s product inventory.

How can blockchain be used in the business world?

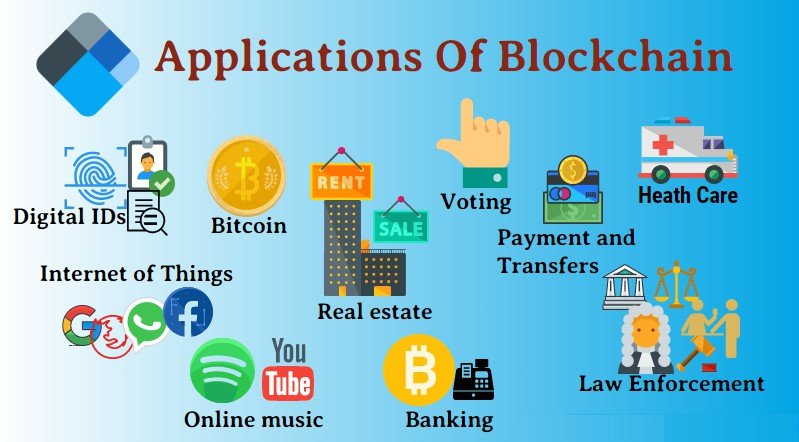

Blockchain has two main applications.

One familiar use of blockchain technology involves trading and managing cryptocurrencies like Bitcoin.

The other main use of blockchain is for managing transactions related to trade and commerce, including finance processes like payable, receivables, and compliance.

We think of these as business blockchains.

Business blockchains are being used today to help reinvent how transactions are managed. They can take time and costs out of almost any process, enabling near real-time operations.

And they deliver a high degree of accuracy and control, with much less risk than many alternatives.

Blockchains perform record keeping using automated, low-cost mechanisms, they enable asset transfer through secure, real-time methods.

And they provide governance in the form of smart contracts.

Smart contracts enforce contract terms such as payment, and thus enable greater trust to the record keeping.

Common finance applications for blockchains include procure-to-pay, order-to-cash, trade finance, inter-company transactions, and reconciliation.

Processes that extend beyond Finance, such as supply chain management, asset tracking, warranty service, and regulatory compliance can also be streamlined using blockchain technology.

Business blockchains can operate as standalone solutions, but the value realized increases significantly when they are combined with other technologies, such as machine learning or Internet of Things, to re-imagine an entire end-to-end process.

How Blockchain aids treasury within finance departments

By bringing all parties across companies into a single platform to allow sharing of real-time information and automated inter-company reconciliation, blockchain can enhance corporate treasury functions.

Key challenges in the treasury still exist.

According to Deloitte’s 2017 Global Corporate Treasury Survey, we see that treasury departments struggle with a variety of challenges that have persisted throughout the years.

Over 200 corporates participated in the survey, and three of the key challenges experienced by the respondents were:

- Problems with FX volatility/fluctuations (53 per cent)

- Visibility into global operations, cash and financial risk exposures (43 per cent)

- Problems with either cash repatriation or liquidity (40 per cent).

For a deep dive into some of the above key challenges, we suggest reading our point of view on inter-company accounting.

To better understand these challenges, we will look at the process of inter-company trade across borders.

When products move from country to country, the asset value of the product is typically booked in the ERP system of the inter-company trade partner in local currency.

In our example, the asset is created and booked in Singapore in SGD.

The asset will be sold to Germany (for further development) and then completed in Denmark.

During the chain of transactions, several challenges could arise.

Currency fluctuations are one of these, as shown in the diagrams above in the loss/profit at each point of transaction.

While the transactions themselves are not difficult to handle, they are still time consuming for modern treasury functions to reconcile.

For every touch-point in the supply chain, humans must interact to ensure that the books are aligned across companies.

The more touch-points in the supply chain, the more time is spent on reconciliation. Ourcustomers experience the following problems when it comes to currency fluctuations and ERP systems:

- The same FX rates are used in ERP systems across geographies or companies, but the value of products changes due to market volatility or fluctuations in the actual FX-rates.

- Different countries have different FX rates loaded in their ERP systems for the same currency pair, which leads to inconsistencies between accounts.

- Different parties across companies can also have different functional currencies in their ERP systems, which makes it difficult to reconcile transactions.

As described above, products are being moved around all the time across companies.

The net FX exposure is therefore ever-changing.

For every country the company does business in, the larger FX risk it exposes itself to.

Today, companies must monitor every combination of FX exchanges for the countries they do business in.

Due to the sheer nature of different currency combinations, it is currently difficult to monitor FX risk in a global company without a proper tool to account for the ever-changing FX exposure. Finally, a challenge arises with the actual transfer of money between the trading companies.

At the moment, the only way to transfer money is through banks.

It can take a bank one-five days to process a transaction, depending on the countries involved and the banks used for the transfer.

This can create a gap in the audit trail of the money flow.

The gap poses a problem as:

- It complicates reconciliation

- It impacts liquidity and visibility

- Bank fees are increased due to high volumes and high frequency of transfers to complicate the matter further, 28 percent of the companies in Deloitte’s 2017 Global Corporate Treasury Survey replied that they currently have no system in place for FX and interest rate risk management, and 7 percent had developed their own solution.

Adding to this, knowledge about next-generation technology enablers was scarce, as 54 per cent were still trying to understand or did not at all understand the concept of blockchain.

Pros and Cons of Blockchain

For all of its complexity, Blockchains potential as a decentralized form of record-keeping is almost without limit.

From greater user privacy and heightened security to lower processing fees and fewer errors, blockchain technology may very well see applications beyond those outlined above.

But there are also some disadvantages.

Pros

- Improved accuracy by removing human involvement in verification

- Cost reductions by eliminating third-party verification

- Decentralization makes it harder to tamper with

- Transactions are secure, private, and efficient

- Transparent technology

- Provides a banking alternative and a way to secure personal information for citizens of countries with unstable or underdeveloped governments

Cons

- Significant technology cost associated with mining bitcoin

- Low transactions per second

- History of use in illicit activities, such as on the dark web

- Regulation varies by jurisdiction and remains uncertain

- Data storage limitations

Conclusion

Many practical applications for the technology are already being implemented and explored, blockchain and working with it and is finally making a name for itself in no small part because of Bitcoin and Cryptocurrency.

As a buzzword on the tongue of every investor in the nation, blockchain stands to make business and government operations more accurate, efficient, secure, and cheap, with fewer middlemen.

As we prepare to head into the third decade of blockchain, it’s no longer a question of if legacy companies will catch on to the technology, it’s a question of when.

Today, we see a proliferation of NFTs and the tokenization of assets.

The next decades will prove to be an important period of growth for Blockchain.